After the news broke last night that Senators Kelly Loeffler (R-Ga.) and Richard Burr (R-N.C.) sold large amounts of stock after receiving an intelligence briefing on the growing Coronavirus outbreak last January, armchair investigators and journalists have been poring over congressional disclosures to see who else may have benefitted financially from their inside knowledge. Now, Senators James Inhofe (R-Okla.) and Dianne Feinstein (D-Calif.) have also been found to have engaged in trading after the briefing.

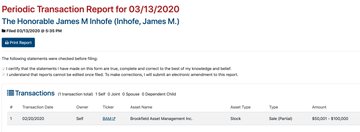

A Twitter user, NYCSouthpaw, posted Inhofe’s disclosures online. The forms show that the Oklahoma Republican sold as much as $500,000 in stocks in the period. Many of the six transactions were within days of the January 24 briefing.

Sen. Feinstein and her husband sold between $1.5 and $6 million in shares of a California biotech company between January 31 and February 18 per reports from MSN. The company, Allogene Therapeutics, which makes cancer treatments, has weathered the stock market crash better than many stocks. At present, it is trading at $20.18 per share, only $1.81 below its one-year high.

The reports come on the heels of reports that Kelly Loeffler and Richard Burr engaged in multiple stock sales worth millions of dollars. Loeffler and her husband made 29 transactions, per the Daily Beast. Only two of the trades were purchases, including buying between $100,000 and $250,000 in Citrix stock. Citrix makes teleworking software.

Sen. Burr engaged in 33 trades valued between $628,000 and $1.72 million per Pro Publica. Burr’s biggest sales included shares of hotel chains Wyndham Hotels and Extended Stay America.

A fifth senator, Ron Johnson (R-Wisc.), also sold a large share of stock, but this transaction appears unrelated to the outbreak. Raw Story notes that Johnson’s sale on March 2 was comprised of interest in a family business. Pacur LLC is a privately traded plastics manufacturing company in Wisconsin.

Another Georgia senator, David Perdue, also reported a large number of stock trades. Many of Perdue’s trades occurred before the briefing, however. Perdue also continued buying into February, purchasing companies that have been damaged by the stock market crash such as Delta Air Lines and Urban Outfitters.

Loeffler, Feinstein, and Inhofe all claim that their trades were made by portfolio managers without their knowledge. Burr released a statement that said that he “relied solely on public news reports” regarding his financial transactions. Burr denied wrongdoing and requested a Senate ethics investigation of his trades.

While there may be a reasonable explanation for the timing of the transactions, the trades smell very fishy. This is especially true since some of the senators who benefitted from trades that seem tailormade to plan for the current pandemic were among those who publicly called concerns about preparations for Coronavirus to be “dangerously and intentionally” misleading.

Loeffler and Burr’s trades seem the most suspicious. This is due to the timing, the number, and the specific stocks involved in the trades.

An ethics investigation seems like a really good idea.

Originally published on The Resurgent

No comments:

Post a Comment