Over the weekend, disturbing evidence of police brutality reared its ugly head once again. Several videos of the death of Tyre Nichols at the hands of Memphis police officers was made public and what they showed was shocking.

The videos are from multiple sources including police body-mounted cameras and a pole-mounted camera view. The footage shows officers violently pulling Nichols from his car after he was stopped for allegedly driving recklessly. Now, even the validity of the stop is in question.

“We’ve taken a pretty extensive look to determine what that probable cause was and we have not been able to substantiate that,” Memphis Police Chief Cerelyn Davis said on Friday. “It doesn’t mean that something didn’t happen, but there’s no proof.”

As the officers pull Nichols from the car, they scream at him to “Get on the ground!” and he initially complies. As officers continue to restrain him, he gets up and runs as the officers shoot tasers and pepper spray at him.

Several officers chased Nichols down about 800 meters away from the initial stop. When they catch him, the officers repeatedly hit and kick Nichols. The beating lasted for about three minutes. Afterward, a handcuffed Nichols was propped against a police car. He was largely ignored and no one rendered aid until about 40 minutes later.

Nichols was taken to the hospital after he complained of shortness of breath. He died there on January 10, about two days after the beating on the evening of January 7. The BBC reported that the preliminary findings by a forensic pathologist listed the cause of death as “extensive bleeding caused by a severe beating.”

Those are the facts. Another fact is that there is no excuse for the actions of the officers who literally beat Nichols to death.

These videos provide some insight into why so many people, particularly black Americans, are frightened of police. We’ve seen a great many examples of overzealous and aggressive officers who give black drivers good reason to fear for their lives, yet this is not just a race-related incident.

The officers who killed Nichols were also black. The problem isn’t white cops assaulting a black motorist. The problem is a more basic issue of police brutality that transcends race.

I’ve written in the past about other incidents of police brutality that include white victims. One of those was Daniel Shaver, an innocent man whose killing at the hands of a police officer was captured in another sickening body camera video. The officer who shot and killed Shaver in 2016 was acquitted and subsequently rehired by the Mesa, Arizona Police Department.

There are elements of a race problem, but what we really have is a policing problem. All too often, officers in these incidents approach their victims in a high-intensity manner than is calculated to frighten and shock criminals into compliance and can instill panic in law-abiding citizens. Panicked people can do stupid things, especially when officers start pointing guns at them or beating them with batons.

When panicked people do stupid things, like running away or resisting, it then gives the officers a reason to escalate the encounter. The perp is disobeying, resisting, and trying to flee. The officer now has reason to fear for his life and a legal rationale to kill the citizen and completely escape punishment.

I’m not in favor of defunding the police, but we do need police reform. One of the first reforms that I would make is to give police officers better training on how to de-escalate potentially violent situations.

Why is it that police negotiators will talk calmly and rationally to an armed hostage-taker, but patrolmen will pull their weapons and start yelling at motorists in a traffic stop, telling them they are going to “ride the lightning” because they didn’t pull over quickly enough?

I think that there are a couple of answers to that question. One is that the negotiator has been trained to calm the situation rather than inflame it. He doesn’t want the hostage-taker to panic and do something stupid that could get a lot of people killed.

A second reason is that hostage-takers are presumed to be armed and motorists are not, although they very well could be. This makes the traffic cops edgy and frightened. These emotions, together with being inadequately trained, sometimes combine to make the officers panic and do stupid things.

A third reason, I believe, is that some cops are just unsuited to the job. Some cops don’t want to be cops. They’d rather be combat troops, which also involves guns and violence, but is a completely different mission. As Rush Limbaugh used to say, the mission of the military is to “kill people and break things.” On the other hand, the mission of the police is to prevent people from being killed and things from being broken. To protect and serve.

Some cops are bad apples who are on power trips. Sometimes putting on a uniform and a gun and the authority that they imply goes straight to the head. Sometimes police officers become bullies. It looks as though the officers in Memphis fit into this category.

So how is it that we get so many situations where people like Tyre Nichols, who now seems to be a totally innocent motorist, are pulled out of their cars and beaten to death or shot and killed like Daniel Shaver, who was minding his own business in his hotel room?

I can think of several reasons. When it becomes hard to recruit police, standards go down. People who shouldn’t be police end up getting hired. Once hired, it can be hard to get rid of bad apples.

The police officer who killed Shaver did it with an AR-15 that was etched with the words, “You’re F-cked.” To me, that paints a picture of a person who may want to shoot someone and could look for any excuse to do so.

All too often there is also a lack of accountability. With several of the incidents of the past few years caught on video by cameras worn by the officers involved, I have to ask myself why any cop would beat an innocent man to death in the knowledge that a camera worn on his chest was recording the crime. The answer seems to be that they are so used to doing what they do that they don’t think about the camera.

That begs the question of how many innocent people were beaten and/or killed by police in the days before body cameras or cell phone video. I have to assume that police quite often got away with murder on the grounds that someone resisted or tried to escape. How many more beatings had the Scorpions of the Memphis PD handed down before they killed Tyre Nichols?

Any discussion of police accountability has to include the subject of qualified immunity. Qualified immunity is a legal doctrine that protects government officials from lawsuits when they violate the rights of citizens unless those rights were “clearly established.” While qualified immunity only applies in civil cases, it makes it difficult to hold the police accountable if their actions are short of criminal. Hopefully, the Supreme Court will overturn this horrible precedent someday soon.

And what of the cops who don’t bully the citizens they are supposed to protect? Most cops are good cops, but too often the good cops accept the behavior of bad cops. Good cops should be given more tools to root out the bullies and criminals in their midst.

Police should be empowered to follow an honor code similar to that of the Air Force Academy:

We will not lie, steal, or cheat, nor tolerate among us anyone who does. Furthermore, I resolve to do my duty and to live honorably, (so help me God).

Police officers need to be expected to not only follow the law and rules themselves but to hold their brother officers accountable. In the end, it isn’t those who report the bad behavior of dirty cops that undermines faith in the police. Instead, it is the bad cops who make innocent citizens fear for their lives.

Tyre Nichols's death was tragic and all the more so because it did not have to happen. Statistically, this sort of thing doesn’t happen often, but we should not accept that it has to happen at all.

That also doesn’t mean that I advocate for violence. I’m glad that the protests in the wake of Nichols’s death have been peaceful, (there seemed to be more violence in Philadelphia during and after the Eagles’ playoff victory yesterday) but if ever a peaceful protest was needed, it is now. The system needs to change and voters need to get the attention of Congress and state legislatures.

To say that police should not pull people from their cars and beat them to death should not be controversial. It also should not be controversial to acknowledge that the system needs to be reformed.

PAUL PELOSI VIDEO: In other video news, a San Francisco judge ordered the release of several videos detailing the attack on Paul Pelosi last October. The videos show David DePape breaking into the Pelosi residence and violently attacking Nancy Pelosi’s husband when confronted by police.

DePape, who has pled not guilty, has previously admitted to targeting Nancy Pelosi in a hostage plot and planning to attack others such as Gavin Newsome and Hunter Biden.

DePape spoke with a local television station, KTVU, on Friday and apologized that his attack was not successful.

"I want to apologize to everyone,” DePape said. “I messed up. What I did was really bad. I'm so sorry I didn't get more of them. It's my own fault. No one else is to blame. I should have come better prepared."

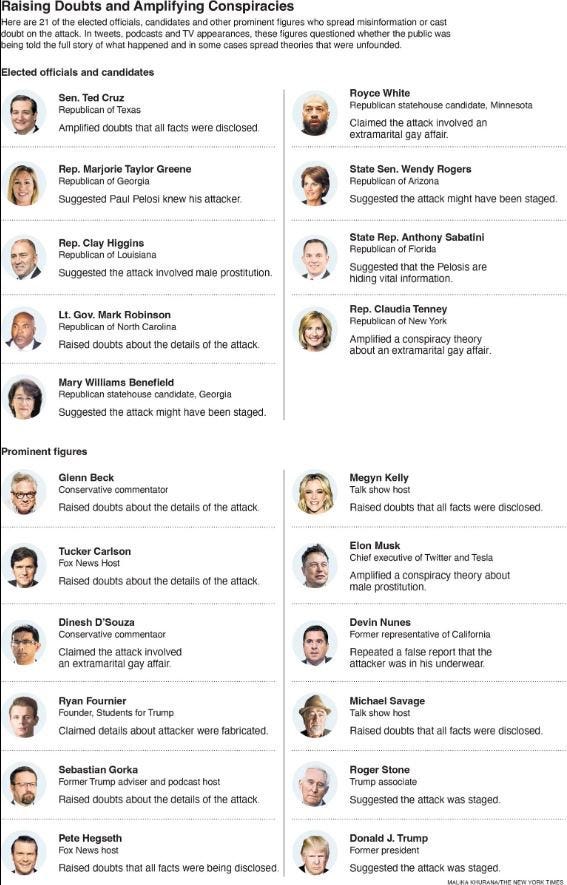

The incident was characterized in various ways by a multitude of right-wing personalities. Some called it a homosexual tryst or drug deal gone bad. The videos disprove those conspiracy theories and the Seattle Times has helpfully created a graphic that shows who you definitely should not listen to in the future.

USAF GENERAL’S WAR WARNING: The four-star general commanding the Air Mobility Command issued a memo warning his troops that he sees war with China likely in 2025.

Gen. Mike Minihan, who I am pretty sure was the guest speaker at my son’s graduation from Basic Military Training last year, said, “I hope I am wrong. My gut tells me we will fight in 2025. Xi secured his third term and set his war council in October 2022. Taiwan’s presidential elections are in 2024 and will offer Xi a reason. United States’ presidential elections are in 2024 and will offer Xi a distracted America. Xi’s team, reason, and opportunity are all aligned for 2025.”

I hope he’s wrong as well, but the world’s focus on Ukraine and the depletion of many stocks of weapons and ammunition do give China an opportunity to make a move on Taiwan.

The best way to avert a war is to be prepared for it and to let the enemy know that you are prepared. I think that was Gen. Minihan’s intention, but I can guarantee you that there will be no war with China unless China starts it.